distinction between calendar yr and financial yr

Associated Articles: distinction between calendar yr and financial yr

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to distinction between calendar yr and financial yr. Let’s weave attention-grabbing data and supply contemporary views to the readers.

Desk of Content material

The Calendar Yr vs. The Fiscal Yr: Understanding the Distinction and its Implications

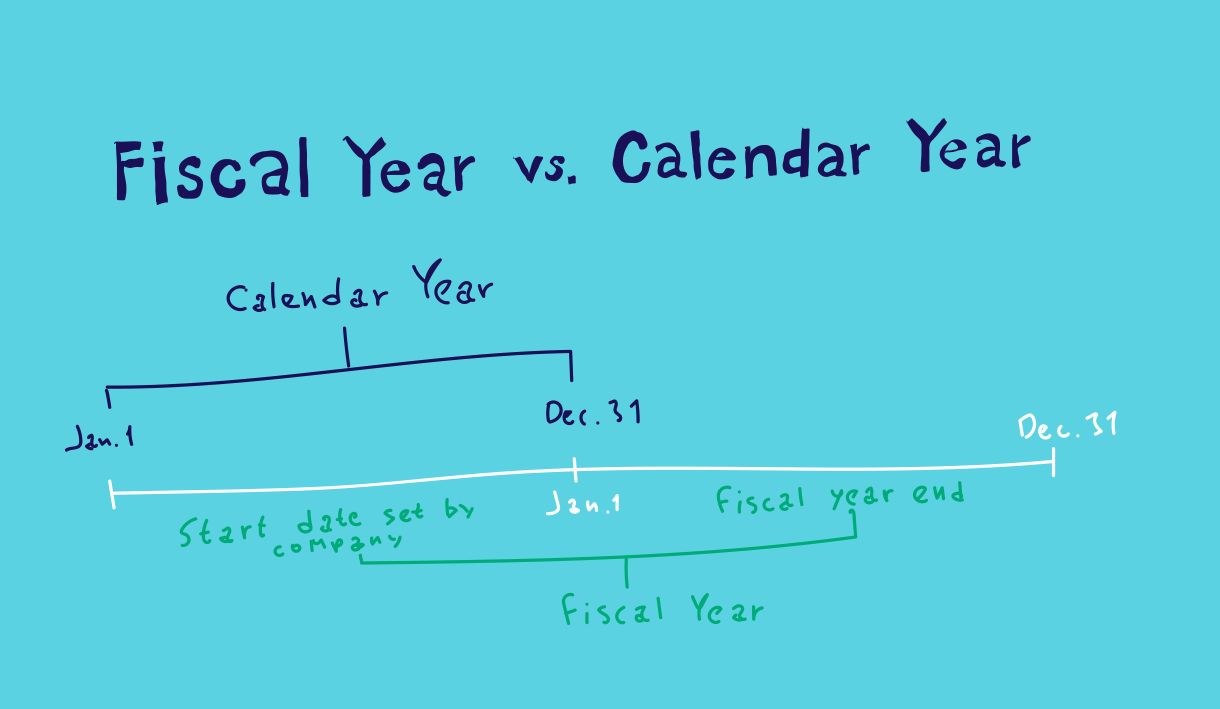

The ideas of "calendar yr" and "fiscal yr" are basic to accounting, budgeting, and monetary reporting. Whereas seemingly simple, the excellence between them is essential for understanding monetary statements, enterprise planning, and governmental operations. Complicated the 2 can result in misinterpretations of monetary efficiency and inaccurate projections. This text delves deep into the variations between these two timeframes, exploring their origins, purposes, and the implications of utilizing one over the opposite.

The Calendar Yr: A Common Timekeeper

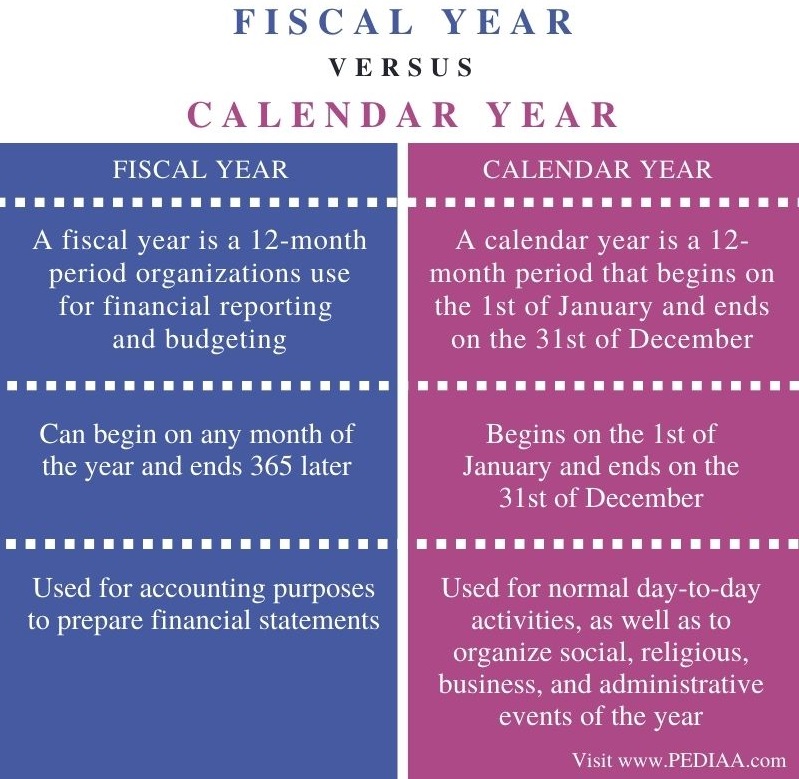

The calendar yr is a universally acknowledged interval of 12 months, starting on January 1st and ending on December thirty first. It aligns with the Gregorian calendar, probably the most broadly used calendar system globally. Its simplicity and widespread acceptance make it a handy benchmark for varied functions, together with private record-keeping, social occasions, and a few, however not all, enterprise actions.

The calendar yr’s benefits lie in its inherent familiarity and ease of use. Everybody understands its construction, making it excellent for normal communication and comparisons throughout completely different entities. Its fastened begin and finish dates simplify knowledge assortment and evaluation, significantly for organizations that do not require specialised monetary reporting intervals.

Nevertheless, the calendar yr’s simplicity is usually a limitation. Its inflexible construction would not all the time align with the pure enterprise cycles of many organizations. For instance, an organization whose peak gross sales happen within the autumn may discover that their calendar year-end monetary statements do not precisely mirror their annual efficiency, as the ultimate quarter may be artificially inflated or deflated relying on the timing of their gross sales cycle.

The Fiscal Yr: A Tailor-made Timeframe for Enterprise and Authorities

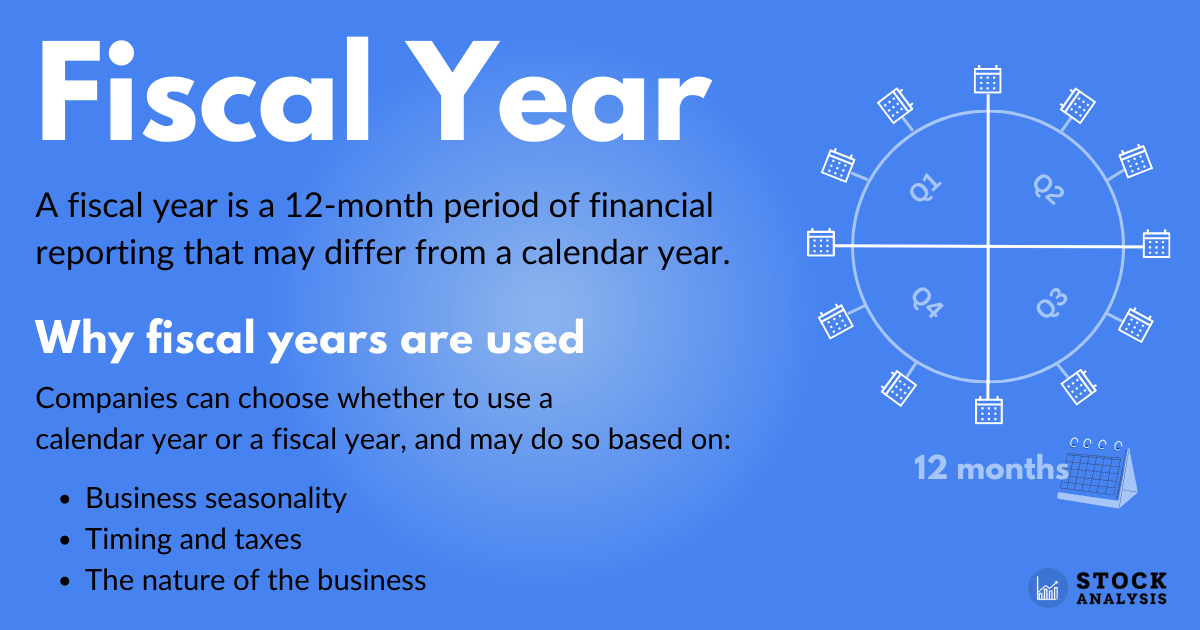

The fiscal yr (FY), in distinction, is a 12-month accounting interval adopted by companies, governments, and different organizations for monetary reporting and budgeting functions. Not like the calendar yr, the fiscal yr’s begin and finish dates aren’t fastened. They’re chosen strategically to align with the group’s operational cycle, permitting for a extra correct reflection of its monetary efficiency.

The pliability of the fiscal yr is its main benefit. Organizations can choose a fiscal yr that most accurately fits their particular enterprise wants. For instance:

- Retailers: Typically select a fiscal yr that ends after the vacation procuring season (e.g., January thirty first or February twenty eighth) to seize the majority of their annual gross sales in a single fiscal yr.

- Agricultural companies: Would possibly align their fiscal yr with their planting and harvesting seasons for higher monitoring of crop yields and associated bills.

- Governmental entities: Usually use a fiscal yr that aligns with their budgeting and appropriation cycles, usually ending on June thirtieth or September thirtieth.

This strategic choice permits for a extra significant evaluation of monetary efficiency and facilitates higher budgeting and forecasting. By aligning the fiscal yr with the enterprise cycle, organizations can acquire a clearer image of their profitability, money movement, and total monetary well being.

The pliability of the fiscal yr, nevertheless, additionally introduces some complexities. Evaluating monetary knowledge throughout organizations with completely different fiscal years requires cautious adjustment and conversion. Furthermore, the selection of a fiscal yr wants cautious consideration, as a poorly chosen interval can hinder correct monetary evaluation.

Key Variations Summarized:

| Characteristic | Calendar Yr | Fiscal Yr |

|---|---|---|

| Begin Date | January 1st | Variable, chosen to go well with the group’s wants |

| Finish Date | December thirty first | Variable, chosen to go well with the group’s wants |

| Period | 12 months (fastened) | 12 months (fastened) |

| Objective | Common timekeeping, social occasions, some enterprise actions | Monetary reporting, budgeting, and planning |

| Flexibility | Low | Excessive |

| Alignment | Fastened to Gregorian calendar | Aligned with the group’s operational cycle |

| Comparability | Straightforward throughout organizations | Requires adjustment for various finish dates |

Implications of Utilizing Totally different Timeframes:

The selection between a calendar yr and a fiscal yr has important implications for varied elements of a company’s operations:

- Monetary Reporting: Fiscal years present a extra correct illustration of a company’s annual efficiency, particularly for companies with seasonal gross sales or manufacturing cycles. Calendar yr reporting may obscure essential developments or distort profitability.

- Budgeting and Forecasting: Fiscal years permit for higher budgeting and forecasting as a result of they align with the group’s operational rhythm. This permits for extra correct useful resource allocation and efficiency monitoring.

- Taxation: Tax filings are sometimes based mostly on the fiscal yr, making it essential for organizations to grasp and adjust to related tax rules.

- Investor Relations: Buyers usually depend on fiscal yr monetary statements to evaluate a company’s efficiency and make funding selections. Constant use of a fiscal yr enhances transparency and comparability.

- Inner Administration: Utilizing a fiscal yr that aligns with the group’s operational cycle simplifies inner administration, permitting for simpler monitoring of efficiency and useful resource allocation.

Examples of Fiscal Yr Finish Dates:

Totally different organizations undertake various fiscal year-end dates based mostly on their particular wants. Some widespread examples embody:

- June thirtieth: Continuously utilized by authorities companies and a few non-profit organizations.

- July 1st: One other fashionable selection for governmental our bodies.

- December thirty first: Some organizations align their fiscal yr with the calendar yr for simplicity.

- March thirty first: Widespread amongst corporations in sure industries, permitting them to seize the top of a key gross sales interval.

- Different dates: Organizations could select different dates to optimize their monetary reporting based mostly on their distinctive enterprise cycle.

Changing Between Calendar and Fiscal Years:

When evaluating knowledge throughout organizations utilizing completely different fiscal years, it is essential to transform the info to a typical timeframe. This usually entails adjusting for the overlapping months between the fiscal and calendar years. Specialised accounting software program and methods are sometimes used to facilitate this conversion.

Conclusion:

The selection between a calendar yr and a fiscal yr is a important determination for any group. Whereas the calendar yr presents simplicity and common understanding, the fiscal yr offers the flexibleness to align with a company’s distinctive operational cycle, resulting in extra correct monetary reporting, higher budgeting, and improved inner administration. Understanding the nuances of each timeframes is crucial for anybody concerned in monetary evaluation, enterprise planning, or governmental operations. The important thing lies in choosing the timeframe that greatest displays the group’s particular wants and objectives, making certain correct monetary illustration and knowledgeable decision-making.

Closure

Thus, we hope this text has offered useful insights into distinction between calendar yr and financial yr. We thanks for taking the time to learn this text. See you in our subsequent article!